Introduction: Why insurance is as important as acquisition

Collecting art in India has matured from passion projects to structured investments. Whether it’s a family legacy of Indian modern masters, a contemporary photography collection, or a corporate art program, one reality remains: artworks are vulnerable.

Fire, theft, flood, accidental damage, pests, or even mishandling during transit—each risk has the potential to diminish or destroy irreplaceable cultural and financial assets. Insurance becomes the safety net. But here’s the catch: insurance is only as good as the valuation that underpins it.

This blog explores how valuation for insurance works, why it matters, and what Indian collectors and institutions must know to protect their collections from risk.

Understanding art insurance in India

Art insurance is not the same as insuring electronics or property. It requires specialised policies that account for the unique risks, market dynamics, and cultural value of artworks.

What art insurance typically covers:

- Fire and natural disasters (flood, earthquake, storm).

- Theft or burglary.

- Accidental damage (e.g., dropping a sculpture during relocation).

- Transit and exhibition coverage (domestic or international).

- Restoration costs after damage.

What it usually excludes:

- Normal wear and tear.

- Gradual deterioration (fading, humidity-related issues if preventive steps weren’t taken).

- War, terrorism, or nuclear risks.

Policies differ across insurers in India, making clear valuation reports even more critical.

Why valuation is the foundation of insurance

An insurance policy requires a declared value for each artwork. If the number is wrong, the coverage becomes meaningless.

- Overvaluation: Leads to higher premiums and may cause disputes during claims.

- Undervaluation: Leaves you underinsured, recovering less than replacement cost.

- No valuation: Insurers may refuse coverage or dispute payout.

Professional valuation ensures the numbers are defensible, evidence-based, and acceptable to underwriters.

Types of valuation relevant for insurance

1. Replacement Value

- What it would cost to replace the artwork with a comparable one at today’s retail price.

- This is the most common basis for insurance.

- Higher than fair market value (FMV) because it reflects retail cost, not resale.

2. Current Market Value

- Based on recent auction results or private sales.

- Sometimes used for secondary-market works but less preferred by insurers.

3. Agreed Value

- Collector and insurer mutually agree on a fixed value upfront.

- Prevents disputes but requires solid justification.

4. Scheduled vs Blanket Coverage

- Scheduled: Each artwork is valued individually with documentation.

- Blanket: A total insured value for a collection without itemised breakdown—riskier for large portfolios.

The valuation process for insurance

Step 1: Inventory & Documentation

Prepare a complete inventory with details: artist, title, medium, size, year, provenance, and high-res images.

Step 2: Condition Reports

Insurers want proof of condition before coverage. Professional condition reports act as a baseline.

Step 3: Market Analysis

Appraisers review comparable sales, gallery pricing, and auction data to determine replacement value.

Step 4: Adjustments

Adjust for differences in medium, subject, condition, and market momentum.

Step 5: Issuing a Valuation Report

The report should clearly state:

- Purpose: “For Insurance Coverage”

- Basis: Replacement Value (unless otherwise agreed)

- Methodology and comparables used

- Date and signatures

Step 6: Periodic Updates

Values are not static. Revalue every 30–36 months or when significant market events occur.

Risks of skipping valuation

- Claims disputes: Without documented valuations, insurers may contest amounts at claim time.

- Underinsurance: Collectors often underinsure to save premiums, but this leads to severe losses.

- Inaccurate records: Families and corporates may forget acquisition costs or lack paperwork.

- Market shifts: Values of Indian modern and contemporary art can rise significantly in a short period. Without updates, coverage lags behind reality.

Special scenarios in insurance valuation

Art in transit

Whether for exhibitions, inter-office transfers, or international shipping, transit coverage requires updated valuations. Without them, insurers may cap payouts at outdated numbers.

Temporary exhibitions

Museums and galleries require condition and valuation reports before loan agreements. These protect both lender and borrower.

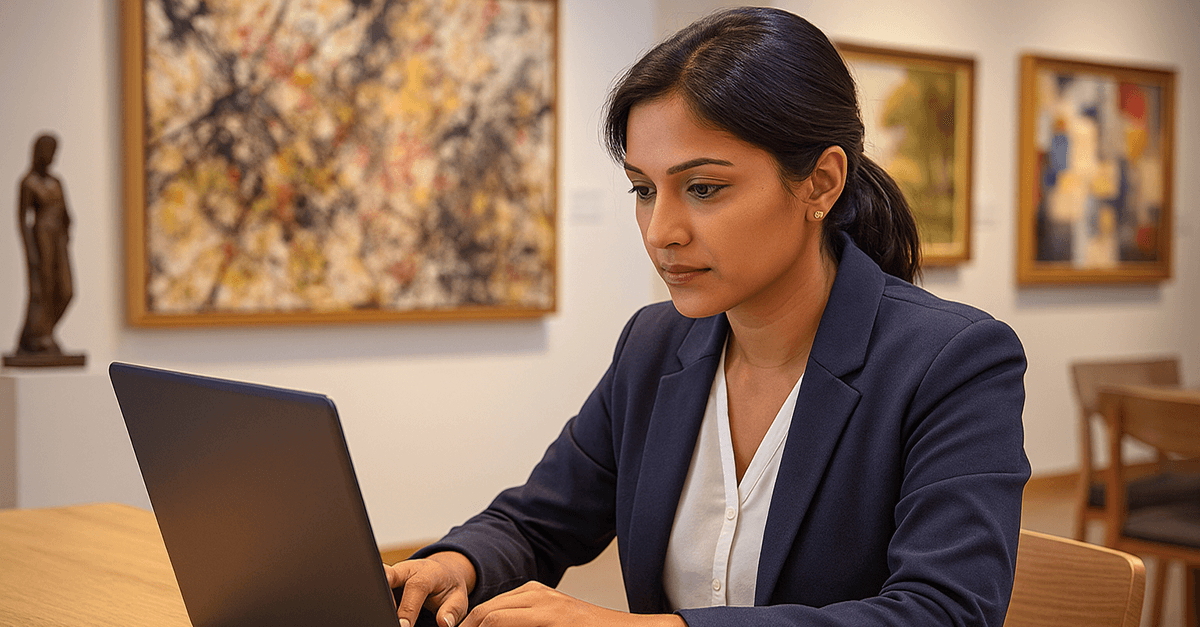

Corporate collections

Corporates often insure entire collections under a single policy. Regular valuations ensure accurate scheduling and avoid disputes with auditors.

Family inheritance

When art collections are passed on, insurance valuations help heirs secure coverage immediately, reducing risk during transition.

Indian market realities for insurance

- Limited awareness: Many collectors assume home insurance covers art. It usually doesn’t.

- Few specialists: Only a handful of Indian insurers and brokers have expertise in art policies.

- Premiums vary: Based on declared values, risk location, and storage/display conditions.

- Documentation gaps: Many collections lack cataloging, making valuations harder.

The solution: integrated cataloging + valuation + insurance advisory.

Case examples (anonymised)

Case 1: Corporate collection in Bengaluru

A corporate client insured its 200-piece collection with valuations prepared for each item. When flooding damaged several works, the insurance payout matched replacement value with no disputes.

Case 2: Private collector in Delhi

Inherited modern Indian paintings but only had original invoices. A fresh valuation showed the works had appreciated 4x in 20 years. Updated coverage ensured accurate protection.

Case 3: Museum in Kolkata

Loaned rare artefacts to an international exhibition. Insurance valuation included not only replacement value but also cost of conservation treatment if damaged, ensuring full coverage.

Best practices for insurance valuation

- Work with professionals: General appraisals aren’t enough; insurers prefer certified reports.

- Always include condition reports: They protect both insurer and collector.

- Opt for scheduled coverage: Especially for high-value individual works.

- Review policies carefully: Check deductibles, exclusions, and transit coverage.

- Revalue regularly: Every 18–24 months or sooner for volatile markets.

- Integrate with cataloging systems: Store reports digitally for easy renewal.

Benefits of proper valuation for insurance

- Peace of mind: No disputes during claims.

- Financial security: Guaranteed replacement cost if works are lost or damaged.

- Cultural stewardship: Protects India’s heritage in private and institutional hands.

- Institutional credibility: Museums, corporates, and estates gain stronger risk management.

- Ease of legacy planning: Families know collections are financially secure.

Conclusion: Protecting art means valuing it right

Insurance is essential, but without accurate valuation it is little more than a promise. By engaging in professional art valuation for insurance, collectors and institutions in India can safeguard not only the financial worth of their collections but also their cultural legacy.Explore our specialised Art Valuation Services. At TurmericEarth, we align valuations with insurance requirements, conduct professional condition reporting, and ensure your collection is documented and protected—today and into the future.